How to digitize and monetize web3 assets using blockchain technology?

June 16 2025

The digitization of assets using blockchain technology has opened new frontiers in ownership, exchange, and value creation. From physical collectibles and real estate to digital art and in-game items, blockchain technology provides a secure, transparent, and efficient mechanism for representing, managing, and monetizing assets across global networks.

This article breaks down the core principles, workflows, and technologies developers rely on to digitize real-world assets (RWAs) and native digital assets, as well as how to unlock their value in a decentralized ecosystem. We’ll cover everything from NFT creation and marketplace integration to airdrop strategies and performance analytics, ending with a roundup of the top toolkits and frameworks available today.

Key takeaways

- Tokenization allows developers to convert ownership rights of real-world assets (RWAs) or digital assets into blockchain-based tokens (e.g., ERC-721, ERC-1155, ERC-20).

- Developers can monetize tokenized assets through primary sales, secondary royalties, token-gated access, subscriptions, and licensing models.

- Best practices for web3 asset monetization include integrating with NFT marketplaces, analyzing asset performance using onchain data tools and APIs, while ensuring cross-chain interoperability.

What is tokenization in blockchain?

Tokenization is the process of converting the ownership or rights of a real-world or digital item into a digital token on the blockchain. These tokens serve as representations of the underlying asset, and anyone can track and verify their ownership or provenance.

Considering the two major token types, they can be either:

- Fungible tokens (e.g., ERC-20): divisible assets like currencies or credits

- Non-fungible tokens (NFTs, e.g., ERC-721, ERC-1155): unique items like digital art, game skins, and real estate titles.

Why tokenize an asset? It can be for multiple reasons:

- Ownership becomes programmable and enforceable through smart contracts.

- Transfers become borderless and permissionless, accessible from any location with internet access.

- Liquidity increases as assets become tradable in decentralized markets.

- Security improves as blockchain records are immutable and publicly auditable.

Tokenization does not limit itself to digital art. Today, we tokenize music, in-game items, luxury goods, contracts, real-world collectibles, and more.

How to digitize assets on the blockchain (tokenization)

The process of digitizing (tokenizing) an asset onchain, whether physical or digital, follows several logical steps 👇

1. Define the asset: First, determine the type and properties of the asset. For example:

- A digital artwork may need metadata like creator, title, description, and image.

- A real estate asset may require title documentation, coordinates, and legal details.

Understanding the asset structure will influence how to encode and store it onchain. It will also determine whether it makes sense for an item to be onchain at all, like in the case of specific game systems.

2. Choose a blockchain network: Popular EVM chains include Arbitrum, Polygon, ApeChain, and Avalanche. Considerations for selection include:

- Transaction fees (gas)

- Decentralized network speed and scalability

- Ecosystem support (web3 wallets, marketplaces, etc.)

Interoperability and cross-chain compatibility are increasingly important in today’s web3 infrastructure.

3. Design the token standard: Developers must select a token standard based on the use case:

- ERC-721 for unique tokens (e.g., artwork, land titles)

- ERC-1155 for batch minting or semi-fungible tokens (e.g., game items)

- ERC-20 for fungible assets like credits, points, or currencies

Define the metadata schema and functionality (including transfer rules, royalties, time locks, etc.) within the smart contract.

4. Mint the token: Minting is the act of publishing the token to the blockchain. This typically includes:

- Hosting metadata on IPFS or a decentralized storage platform.

- Deploying a smart contract or using an existing factory contract.

- Sending the token to a wallet address, which may belong to the creator or buyer.

Minting can be triggered from frontend UIs, backend scripts, or CLI tools, depending on the web3 stack.

How to monetize tokenized assets

Once assets are digitized, developers and creators have several avenues to generate income:

1. Primary sales: Sell or distribute the tokenized assets directly to users. This is commonly used in:

- Airdrops: mechanisms to send tokens to multiple users' wallets, often for free.

- Game item sales

- Ticketing systems (e.g., for events)

As one example in gaming, the renowned FPS title Off The Grid, integrated NFTs into its core gameplay. Smart contracts can enable time-limited sales, price tiers, or auction formats.

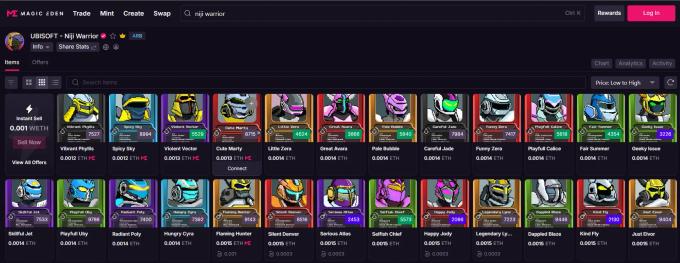

2. Secondary royalties: Define royalties in the smart contract so that creators receive a percentage of each resale. This model supports recurring revenue as assets change hands across marketplaces.

3. Token-gated access: Offer services or content uniquely to token holders. Examples include:

- Premium communities

- Educational content

- Virtual land access in games or metaverses

4. Subscriptions and licensing: Use NFTs as licenses or access keys that can expire. These can power:

- Software subscriptions

- Content/items rental

- Membership programs

Best practices for monetizing onchain assets

Once assets are tokenized and live onchain, the next critical steps involve making them accessible, marketable, and interoperable. These are some of the best practices web3 developers and collectors can follow when designing their assets and launching onchain:

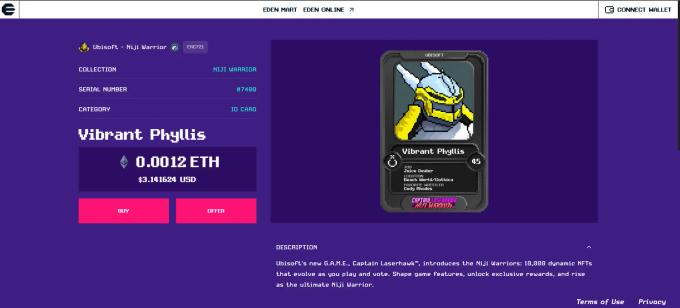

Integrating NFT Marketplaces into applications: NFT marketplaces play a central role in monetizing digital assets. Developers can choose between existing marketplaces like Magic Eden, OpenSea, LooksRare, or Blur, or custom marketplaces tailored to a project’s branding, logic, and monetization strategies.

Tracking and analyzing success across the web3 lifecycle: Performance analysis is critical to evaluating the impact and sustainability of tokenized assets in onboarding, engagement, and retention efforts. Developers can analyze this data by querying blockchain explorers (e.g., Etherscan), integrating APIs that track wallet and contract activity, or building dashboards for real-time tracking and analytics.

Ensuring cross-chain compatibility: With the rise of multiple Layer 1, Layer 2, Layer 3 chains, cross-chain asset management is a necessity. Cross-chain availability expands market reach and improves UX, enabling users to interact with assets in their preferred environments. Developers can achieve this by deploying smart contracts on multiple networks, implementing standards that support chain abstraction, using token bridges to transfer assets between chains, and tracking cross-chain inventories and ownership.

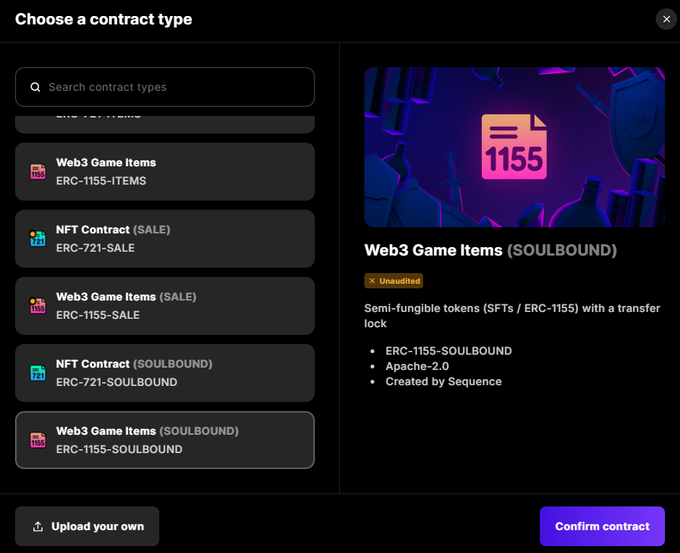

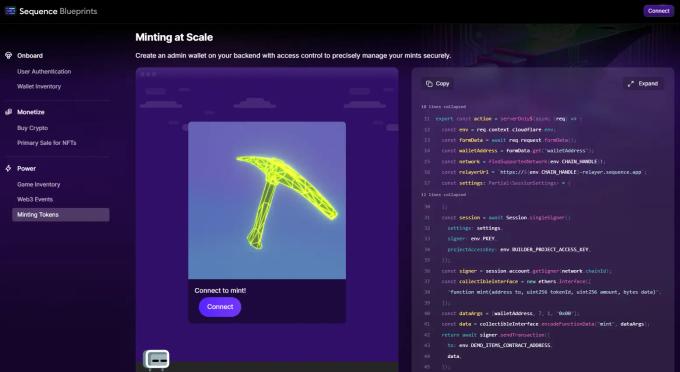

Leveraging Sequence’s web3 platform to create and monetize onchain assets

Digitizing and monetizing assets often requires stitching together multiple tools and smart contracts, but with Sequence’s web3 development stack web3 development stack, creators can streamline every step of the process, from onchain asset creation to management and monetization.Sequence Collections enables developers to create, manage, and deploy NFT collections with customizable metadata, royalty settings, and contract configurations, all without needing deep blockchain expertise. It supports streamlined minting, onchain and offchain metadata storage, gas sponsorship, and seamless integration into apps and marketplaces for full control over the NFT lifecycle.

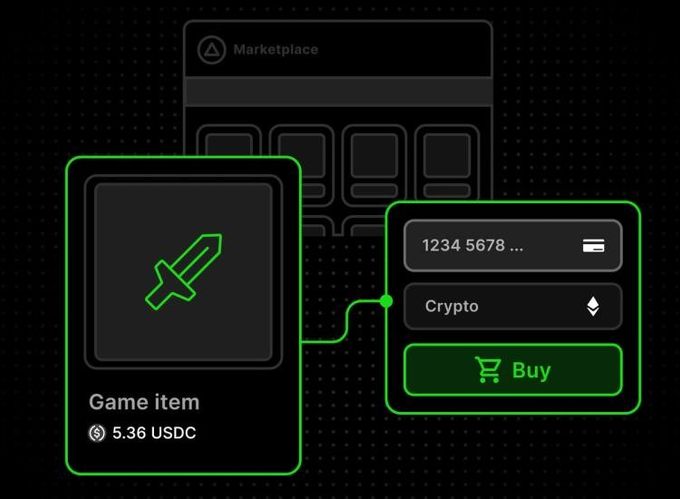

Sequence Marketplace solutions enable both white-label and custom marketplaces, enabling developers to launch fully branded NFT marketplaces with flexible design, pricing, and royalty configurations.

Sequence Pay allows developers to seamlessly accept both crypto and fiat payments within their apps, supporting a wide range of currencies and chains. It includes APIs and SDKs for integrating checkout flows, subscriptions, and one-time purchases, ensuring a smooth user experience across payment methods.

Sequence Analytics provides developers with real-time insights into user behavior, asset performance, and transaction activity across their web3 applications. It enables data-driven decision-making through dashboards and APIs that track mints, transfers, sales, and wallet engagement across multiple chains.

Start tokenizing and monetizing your assets with Sequence

- Sign up for free on Sequence Builder, our all-in-one web3 development platform.

- Leverage our smart contract templates for NFT drops, in-app or custom marketplaces, and airdrops.

- Explore our Blueprints: open-source and ready to be customized or forked.

- Reach out to our team for support along the way.

Sequence makes building onchain simple. Developers and teams can launch, grow, and monetize apps with unified wallets, 1-click cross-chain transactions, and real-time data, all in a modular and secure stack. No more stitching together fragmented tools or battling poor user flows. Sequence is production-ready infrastructure that helps teams ship faster, onboard more users, and scale confidently. From chains and stablecoins to DeFi and gaming, Sequence powers developers and applications across the EVM ecosystem with billions in transaction volume and millions of users. Trusted by leaders in blockchain, Sequence powers today’s onchain apps and delivers future-proof infrastructure for tomorrow’s breakthroughs. Learn more at sequence.xyz.

Written by

Sequence team

Sequence logoRelated Posts

Today marks a major milestone: Polygon Labs is acquiring Sequence.

A short guide that explains exactly what gasless transactions are, and why they matter for your web3 experience.

In partnership with KOR Protocol, Sequence and Msquared, Black Mirror's franchise has launched the $MIRROR token and a new web3 experience!

Web3 payment flows allow any app to embed onchain purchases and interactions in a way that feels natural for users. Learn more about them!