Which structural challenges keep crypto payments from scaling?

September 16 2025

Crypto has the ecosystem, the liquidity, and the attention. But it still hasn’t broken into true mass adoption.

Billions in DeFi, NFTs, and blockchain gaming flow across chains every day, yet the industry remains siloed. The barriers aren’t just about user friction. They are structural challenges faced by DeFi platforms, marketplaces, and stablecoin issuers.

Let’s break them down.

1. The multi-chain strain on DeFi platforms

DeFi protocols are built for innovation but trapped by fragmentation. Each EVM chain brings its own quirks: gas fee mechanics, liquidity pools, and smart contracts.

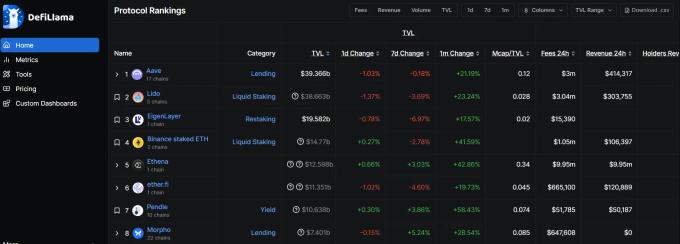

Protocols stretch across chains, but liquidity doesn’t. On the one hand, liquidity still remains concentrated over a few players: As of May 2025, Aave held approximately 45% of total TVL in DeFi, amounting to around US $25.4 billion.

On the other hand, web3 developers manage multiple instances of the same product, draining resources and diluting depth. For every new integration, there’s another silo. Instead of one unified onchain system, DeFi lives in a scattered, multi-chain maze.

2. Marketplaces fragmented by liquidity

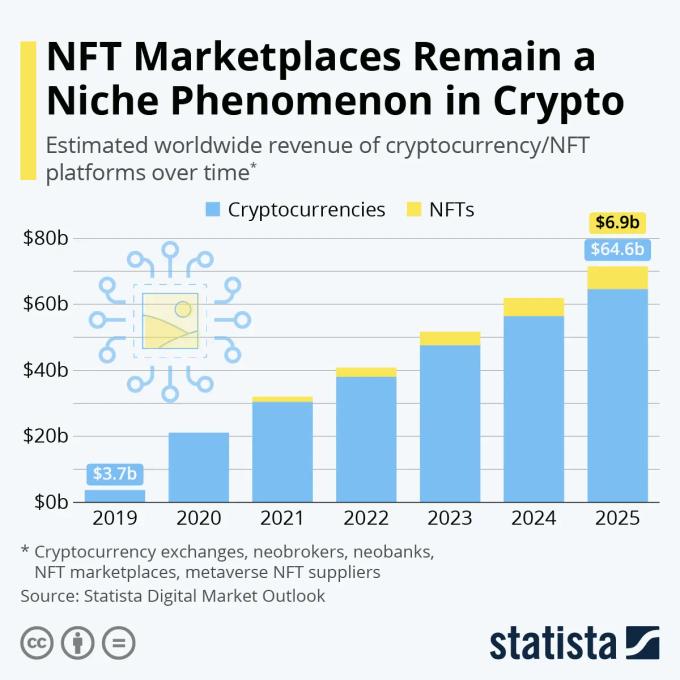

From NFTs to real-world assets (RWAs), marketplaces struggle with liquidity silos. Assets are trapped on the chain they launched on, and cross-chain discovery is underdeveloped. A pity, considering the global NFT market reached $34.1 billion in 2025, with Ethereum powering nearly 62% of all NFT transactions.

Each marketplace fights to attract supply and demand within its own walls. Without unified liquidity rails, marketplaces remain fractured, limiting network effects. What should be a single global bazaar becomes dozens of isolated storefronts, each with shallow liquidity. The number of active NFT marketplaces grew to 112 platforms by 2025, indicating an increasingly fragmented ecosystem without unified liquidity rails.

3. Stablecoin issuers locked in silos

Stablecoins should be the backbone of web3 payments and crypto checkout. In May 2025 alone, for example, Ethereum's Layer‑1 recorded a high of $480 billion in stablecoin transfer volume, surpassing Visa’s throughput. Also, estimates indicate that USDC supply in smart contracts grew by up to 42% compared to 2024.

Yet despite this scale, stablecoins remain fragmented, and liquidity is locked up by design. A token on Ethereum doesn’t automatically work on Polygon. USDC and USDT don’t move seamlessly across ecosystems. Yield protocols further lock liquidity by competing for TVL, prioritizing capital capture over interoperable payment rails.

Today, although stablecoin transaction volumes are massive, only around 6% of demand (≈ $15 billion) is tied to everyday payments.

Issuers face structural hurdles that compound fragmentation: regulatory oversight, collateral management, compliance frameworks, and liquidity provisioning across incompatible networks. Scaling requires solving these at once, but today stablecoins grow in volume while staying siloed, limiting their reach as a universal money.

These infrastructure gaps spill directly into the user experience. Merchants and consumers face a fractured, high-friction environment where payments don’t just “work.” A buyer holding USDC on Optimism can’t simply pay a seller on Polygon without incurring bridging delays, fees, or security risks.

Until stablecoins function like true “universal internet money”, thus interoperable, frictionless, and widely accepted, they remain constrained by the very rails they depend on.

4. Ecosystem fragmentation across the board

The crypto ecosystem is still defined by silos. DeFi apps, blockchain gaming, NFT marketplaces, and stablecoin rails all face the same challenge: fragmentation.

- Liquidity is scattered.

- Protocols duplicate effort.

- Cross-chain routes remain fragile.

- Gasless transactions and chain abstraction are more aspiration than reality.

Instead of one internet-native system, crypto is a patchwork of chains, web3 wallets, and liquidity pools. Until the stack unifies, every participant, either protocol, issuer, or marketplace, remains constrained.

Final Thoughts: Structural barriers to scale

Crypto doesn’t just face adoption challenges at the user level. It faces structural challenges at the platform level.

DeFi protocols are strained by multi-chain maintenance. Marketplaces are fractured by liquidity silos. Stablecoins are limited by fragmented deployments.

These barriers define the current state of crypto. They are why adoption is stalled, why infrastructure struggles to scale, and why the ecosystem still feels more like parallel islands than a global network.

Mass adoption is blocked by structure.

To learn more about Sequence solutions for UX and crypto payment hurdles, visit www.sequence.xyz

Sequence makes building onchain simple. Developers and teams can launch, grow, and monetize apps with unified wallets, 1-click cross-chain transactions, and real-time data, all in a modular and secure stack. No more stitching together fragmented tools or battling poor user flows. Sequence is production-ready infrastructure that helps teams ship faster, onboard more users, and scale confidently. From chains and stablecoins to DeFi and gaming, Sequence powers developers and applications across the EVM ecosystem with billions in transaction volume and millions of users. Trusted by leaders in blockchain, Sequence powers today’s onchain apps and delivers future-proof infrastructure for tomorrow’s breakthroughs. Learn more at sequence.xyz.

Written by

Sequence team

Sequence logoRelated Posts

Today marks a major milestone: Polygon Labs is acquiring Sequence.

A short guide that explains exactly what gasless transactions are, and why they matter for your web3 experience.

In partnership with KOR Protocol, Sequence and Msquared, Black Mirror's franchise has launched the $MIRROR token and a new web3 experience!

Web3 payment flows allow any app to embed onchain purchases and interactions in a way that feels natural for users. Learn more about them!