What’s stopping mass user adoption of crypto payments?

September 9 2025

For all its hype, crypto still struggles with one of its most basic promises: paying for things easily. Despite billions in market capitalization, only a fraction of crypto holders use their assets for everyday transactions. The reasons are less about willingness and more about friction.

Most people don’t care how crypto payments work, only that they do. If a checkout page is confusing, if the gas fee is unclear, or if the web3 wallet connection fails, users simply close the browser and move on.

The problem is that crypto has normalized these roadblocks, while mainstream users demand instant, reliable, universal payments. Until that gap closes, adoption will stall.

Let’s break down the key barriers holding back mass adoption of crypto payments.

1. The triple fragmentation problem

The crypto industry has made significant progress to scale blockchains, improve wallet experiences, and advance the Internet’s digital asset era. But this progress and scaling have also fragmented liquidity, buying power, and user experiences. Today, in the U.S., only 2% of adults report making purchases through crypto.

Value is distributed across many chains, tokens, and wallets:

- A wallet may only support one EVM chain at a time.

- Tokens often need to be swapped or bridged before use.

- Users may hold funds across multiple accounts, each inaccessible without tedious steps.

This fragmentation makes even simple actions unnecessarily complex.

For example, getting USDC into a DeFi protocol to earn yield, or simply making a payment, often requires multiple steps: bridging, swapping, approvals, gas fees, and more. From a different chain, the process becomes slow and arduous, leading to lower conversion, app abandonment, and user frustration.

What should be as seamless as buying a T-shirt, playing a blockchain game, or accessing a marketplace instead feels like a technical project requiring knowledge of liquidity routing, bridging, and approvals.

2. Failed checkouts and abandoned transactions

Ask any crypto user, and they’ll tell you: transactions fail far too often. Whether it’s a token mismatch, an underfunded gas fee, or a misconfigured chain, crypto checkouts are fragile. Fiat‑to‑crypto on‑ramp transactions might fail up to 50% of the time. And due to the complexity of the process, transaction abandonment can skyrocket to 90%.

Every failed transaction is a broken promise. Users get frustrated, apps lose trust, and developers lose revenue. In web2 commerce, abandoned carts are already a big problem. In crypto, abandoned transactions multiply because of the extra friction at checkout, whether for DeFi apps, NFT purchases, or even web3 gaming.

3. Complexity of payments

Crypto users face a steep learning curve before they can even make their first payment. They must understand concepts like:

- Gas fees: unpredictable and often confusing.

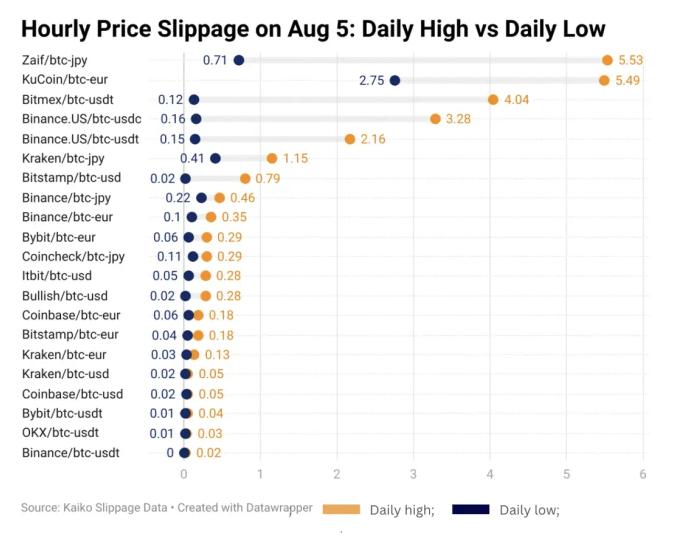

- Slippage: the risk of losing value when swapping tokens.

- Bridging: moving funds across chains.

- Approvals: granting permissions before every transaction.

This level of complexity may excite seasoned DeFi users, but it alienates mainstream audiences. Today, 34% of crypto users actively use cryptocurrencies for payments, and 37% cite payments as a key adoption driver, but numbers are still just the tip of the iceberg.

For payments to become truly universal, they need to be as simple as swiping a card or tapping a phone.

4. Stablecoins with limited utility

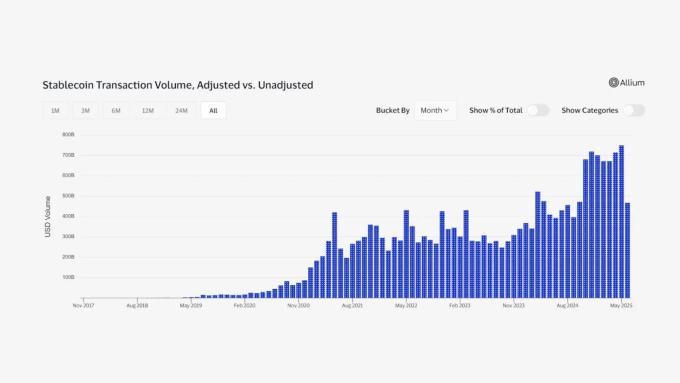

Stablecoins processed over $8.9 trillion in on‑chain volume during the first half of 2025 and saw a 49% year-over-year increase in monthly trading volume, which reflects their expanding use in real-world transactions. They’re touted as the bridge between blockchain and real-world commerce. By design, they offer price stability, making them ideal for payments.

But in practice, fragmentation undermines their utility. A user might hold USDC on Ethereum while a merchant only accepts USDT on Polygon. Without seamless cross-chain liquidity and chain abstraction, stablecoins remain locked in silos, limiting their usefulness for everyday crypto checkout.

5. Barriers for Real-World Asset (RWA) adoption

The rise of tokenized assets, like real estate, collectibles, or even invoices, signals huge potential for onchain commerce. Yet issuers face steep barriers when trying to sell through a marketplace:

- Integrating smart contracts across multiple chains.

- Managing cross-chain liquidity for payments.

- Ensuring compatibility with different web3 wallets.

For RWAs to thrive, the crypto payments layer must evolve from fragmented and fragile to unified and invisible.

Final Thoughts: From potential to usability

Crypto payments are stuck in limbo, not because people don’t want to use their assets (60% of crypto owners are interested in using digital currencies for payments), but because the experience is broken.

The barriers of fragmentation, failed checkouts, and complexity prevent blockchain from fulfilling its promise as a true internet-native currency. Mass adoption won’t come from hype or speculation; it will come when payments just work.

When users can pay with any token, from any wallet, on any chain (without worrying about gas fees, bridges, or approvals) crypto will finally move from potential to usability. And when crypto checkout becomes invisible, web3 development will unlock the next wave of adoption across DeFi, NFTs, RWAs, and even web3 gaming ecosystems.

Until then, crypto remains money people hold, but not money people use.

--

To learn more about Sequence solutions for UX and crypto payment hurdles, visit www.sequence.xyz

Sequence makes building onchain simple. Developers and teams can launch, grow, and monetize apps with unified wallets, 1-click cross-chain transactions, and real-time data, all in a modular and secure stack. No more stitching together fragmented tools or battling poor user flows. Sequence is production-ready infrastructure that helps teams ship faster, onboard more users, and scale confidently. From chains and stablecoins to DeFi and gaming, Sequence powers developers and applications across the EVM ecosystem with billions in transaction volume and millions of users. Trusted by leaders in blockchain, Sequence powers today’s onchain apps and delivers future-proof infrastructure for tomorrow’s breakthroughs. Learn more at sequence.xyz.

Written by

Sequence team

Sequence logoRelated Posts

Today marks a major milestone: Polygon Labs is acquiring Sequence.

A short guide that explains exactly what gasless transactions are, and why they matter for your web3 experience.

In partnership with KOR Protocol, Sequence and Msquared, Black Mirror's franchise has launched the $MIRROR token and a new web3 experience!

Web3 payment flows allow any app to embed onchain purchases and interactions in a way that feels natural for users. Learn more about them!